Emmet County Divorce commented on by Flint Divorce Attorney Terry Bankert, 810-235-1970. Issues: Spousal support; Woodington v. Shokoohi; Gates v. Gates; Hanaway v. Hanaway; Vanalstine v. Vanalstine; Magee v. Magee

Court: Michigan Court of Appeals (Unpublished 06/22/10),N0.28898, Case Name: Welsh v. Welsh

Emmet Circuit Court N0. 08-001177-DO,e-Journal Number: 46142

Judge(s): Per Curiam - Shapiro and Donofrio; Dissent - Jansen

Summary from de-Journal followed by Case with comments in CAP or [trb ] by Terry Bankert Flint Divorce lawyer , for lay understanding ans SEO.

LOCAL COURT DID IT WRONG!

The MICHIGAN COURT OF APPEALS held the EMMET DIVORCDE trial court's award of spousal support to the defendant-wife of $1,000 a month for three years was unfair, inequitable, and erroneous. Thus, the court remanded for a determination of an increased amount and duration of spousal support.

PRIOR TO DIVORCE HUSBAND AND WIFE HAD AN AGREEMENT

Prior to trial, the parties reached an agreement on all issues except spousal support. As part of their agreement, they stipulated to a division of the marital property with each receiving approximately $207,000 in assets.

AFTER DIVORCE WIFE SAYS SHE WANTS MORE SPOUSAL SUPPORT

On appeal, defendant challenged numerous factual findings by the trial court and contended the amount of spousal support awarded was unfair where she requested permanent spousal support of $3,000 a month.

COURT OF APPEALS AGREES WITH WIFE

The court agreed. In considering the plaintiff-husband's ability to pay alimony, the EMMET COUNTY DIVORCE trial court took into account the husband's duty to repay a loan he acquired to pay defendant for her share of the parties' real property, and noted defendant "was going to be saddled with debt to pay the settlement."

YOU CANNOT DO THAT SAYS THE HIGHER COURT

The court held this was error because the trial court should not have considered this. Plaintiff did not have less than $207,000 in assets because of this. Rather, he had to make the payment because he had more than $207,000 in assets. Defendant's spousal support calculation should not have been reduced because of this decision.

HUSBAND ASSETS ARE INCOME PRODUCING

Also, plaintiff's assets are income-producing assets because he received the business. Defendant received cash, while liquid it earns very little income.

HUSBAND MAKE MUCH MORE THAN WIFE BY A MUL;TIPE OF SEVEN!

Further, plaintiff's income substantially exceeds defendant's, who earns about $8,580 from her part-time job and her net income from a full-time similar job would be about $14,000 a year. His yearly income was about seven times that of defendant.

SPOUSAL SUPPPORT IS TO ALLOW A STANDARD OF LIVING, THE CIOURT NEEDED A BUDGET

Also, the trial court made its decision on the amount of spousal support without any information as to defendant's living expenses. The MICHIGAN COURT OF APPEALS court did not believe the EMMET COUNTY DIVORCE trial court rendered a fair and equitable decision.

It was error for the EMMET COUNTY DIVORCE trial court not to order a greater amount of support for a longer period of time.

This was a 35-year marriage, defendant is 54 years old, has no higher education, and her only work experience was unskilled office work. There was no basis in the record for the trial court's conclusion a three-year period of spousal support was sufficient for defendant to learn new skills and/or secure better employment.

---

BACKGROUND

THERE WAS A TRIAL

Defendant Christine Welsh appeals as of right a divorce judgment issued following a

bench trial.

THERE WAS AN AGREEMENT BEFORE THE TRIAL ALL EXCEPT SPOUSAL SUPPORT

Prior to trial, Christine and Patrick Welsh reached an agreement on all issues except

spousal support.

EACH TO GET VALUE OF $207,000

As part of their agreement, they stipulated to a division of the marital property,

with each receiving approximately $207,000 in assets.foot note 1

WIFE SAYS SHE DID NOT GET ENOUGH SPOUSAL SUPPORT

On appeal, defendant challenges numerous factual findings of the trial court, and argues that the EMMET COUNTY DIVORCE trial court’s award of spousal support of $1000 a month for 3 years, when she requested permanent spousal support of $3000 a month, was unfair and inequitable.

EMMET COUNTY DIVORCE COURT DID IT WRONG, HOW IS THIS DECISION MADE?

We agree and remand for additional proceedings consistent

with this opinion.

WHAT THERE ABUSE OF DISCRETION

“We review a trial court’s decision to award spousal support for an abuse of discretion.

Gates v Gates, 256 Mich App 420, 432; 664 NW2d 231 (2003).

A EMMET COUNTY DIVORCE trial court’s factual findings

regarding spousal support are reviewed for clear error and are presumptively correct. Id. The

appellant has the burden of showing clear error. Id. If this Court determines that the EMMET COUNTY DIVORCE trial court’s findings are not clearly erroneous, this Court must then determine whether the trial court’s decision was fair and equitable in light of the facts. Id. at 433. The trial court’s award of spousal

support must be affirmed unless this Court is firmly convinced that the award was inequitable.

Id.

WHY DOES A COURT AWARD SPOUSAL SUPPPORT?

“The objective of spousal support is to balance the incomes and needs of the parties in a

way that will not impoverish either party, and support is to be based on what is just and

reasonable under the circumstances of the case.” Woodington v Shokoohi, ___ Mich App ___;

___ NW2d ___ (Docket No. 288923, issued May 4, 2010), slip op p 2.

HOW DOES A COURT DECIDE IF THERE SHOULD BE SPOUSAL SUPPORT IF ANY?

In determining whether to award spousal support, a trial court should consider the following factors:

(1) the past relations and conduct of the parties;

(2) the length of the marriage;

(3) the abilities of the parties to work;

(4) the source and amount of property awarded to the parties;

(5) the parties’ age;

(6) the abilities of the parties to pay alimony;

(7) the present situation of the parties;

(8) the needs of the parties,

(9) the parties’ health;

(10) the prior standard of living of the parties and whether

either is responsible for the support of others;

(11) contributions of the parties to the joint estate;

(12) a party’s fault in causing the divorce;

(13) the effect of cohabitation on a party’s financial status; and

(14) general principles of equity.

[Id.]

ARE ANY OF THE ASSETS INCOME PRODUCING?

Additionally, “‘[w]here both parties are awarded substantial assets, the court, in evaluating a

claim for [spousal support], should focus on the income-earning potential of these assets and

should not evaluate a party’s ability to provide self-support by including in the amount available

for support the value of the assets themselves.’” Gates, 256 Mich App at 436, quoting Hanaway

v Hanaway, 208 Mich App 278, 296; 527 NW2d 792 (1995).2

EMMET COUNTY DIVORCE COURT DISCOUNTED WIFES AWARD BY THE LOAN COST OF HUSBAND TO0O PAY HER.

In this case, both plaintiff and defendant received $207,000 in marital assets. In

considering plaintiff’s ability to pay alimony, the trial court took into account plaintiff’s duty to

repay a loan that he had acquired to pay defendant for her share of the couple’s real property, i.e.

2 Plaintiff attempts to argue that Hanaway in distinguishable because it involved wealthy parties.

There is nothing in the opinion that limits its application to only wealthy litigants and such a

proposition is not consistent with the very premise of our judicial system. Furthermore,

Hanaway has been applied to cases where the party paying alimony made only $45,000 and

where the martial assets awarded were only $57,000. See Klesczewski v Klesczewski,

unpublished opinion per curiam of the Court of Appeals, issued August 22, 2000 (Docket No.

213288); Kaylor v Kaylor, unpublished opinion per curiam of the Court of Appeals, issued

December 15, 1998 (Docket No. 204722).

WIFE AND HUSBAND RECEIVE SUBSTANTIAL ASSETS

In any event, the evidence shows that each party received $207,000 in assets. We believe that this is sufficient to constitute “substantial” assets. their house, outbuilding, and approximately 10 acres of land.

HUSBAND SADDFLED WITH PAYING WIFE

The trial court noted in its opinion that defendant was going to “be saddled with debt to pay the settlement.”

EMMET COUNTY DIVORCE COURT WAS WRONG

This was error.

HE OWED IT

That plaintiff had to take out a loan to pay defendant $119,000 of her award is of no

moment and the trial court should not have considered this. Plaintiff does not have less than

$207,000 in assets because of the loan. Rather, he had to make the payment because he had

more than $207,000 in assets—theoretically he had $326,000, thus necessitating the payment.

With plaintiff’s loan, each of the parties would net $207,000 in assets.3 Accordingly, it was

inappropriate to consider plaintiff’s required repayment of the loan when determining either his

ability to pay or the amount he should pay. Plaintiff elected to take out a loan rather than sell

assets. That was certainly his option, but defendant’s spousal support calculation may not be

reduced based on this decision.4 See Vanalstine v Vanalstine, unpublished opinion per curiam of

the Court of Appeals, issued September 22, 2005 (Docket No. 254655) (Concluding that the trial

court properly ignored that the defendant would have to mortgage his property to pay his share of

the property settlement when determining the defendant’s ability to pay spousal support because

the “defendant is not acquiring any existing debt, as he is allowed to choose whether to liquidate

or mortgage the property to plaintiff for her share of its worth”).

HUSBAND GOT THE BUSINESS AND WILL RECEIVE INCOME FROM IT

Moreover, plaintiff’s assets are income-producing assets because he received the

business. Defendant received cash that, although liquid, earns very little income. Accordingly,

although the parties received equal assets, plaintiff received the majority of the incomeproducing

assets.

WIFE MAKES $10 PER HOUR

The evidence also indicates that plaintiff’s income substantially exceeds defendant’s.

The trial court found that the 54-year-old defendant earns $10 per hour as a part-time receptionist

and that her take home pay was $330 biweekly or $8,580 per year based on the available 15 to 22

hours of work per week. The trial court concluded that her monthly net income for full-time

work would be roughly $1,168, which would be just over $14,000 per year. Although we do not

find this conclusion erroneous, the trial court did err in its calculation of plaintiff’s income by

double crediting capital improvements to the business against that income.

THE COURT COMPUTED HUSBANDS INCOME WRONG

The trial court gave plaintiff a double credit for reinvestments into his business. Plaintiff’s CPA testified that over the last six years plaintiff had put on average $22,000 per year back into the business in capital

improvements, although she anticipated that this amount would be less in the future because

much of the work was done.

While we do not take issue with the trial court’s deduction of the capital improvement

expenses from plaintiff’s annual income, the trial court based that annual income on the CPA’s

--

FOOT NOTE 3 That is to say, plaintiff still has $326,000 in assets, but has a loan of $119,000, to render his net assets $207,000.

FOOTNOTE 4 We also note that, although the trial court concluded that plaintiff did not have the ability to pay more spousal support, the conclusion was reached without any evidence as to the plaintiff’s

living expenses. Accordingly, on remand, the trial court shall make its determination of

plaintiff’s ability to pay based solely on evidence.

--

calculations, which set forth plaintiff’s “net income after taxes and depreciation.” The CPA

testified that depreciation is a representation of capital improvements for purposes of taxes,

which require the expenses to be spread out over a certain number of years. Plaintiff was not

entitled to be credited twice for the same expenses. Thus, giving him credit for the full amounts

of the annual capital improvement costs while also giving him credit for depreciation listed on

his taxes was clearly erroneous. The capital improvement expenses should have been subtracted

from the “net income after taxes and before depreciation.” By doing so, defendant’s net income

in 2003, 2004, 2005, 2006 and 2007 after taxes and capital improvements was $59,181, $55,050,

$63,018, $34,137,5 and $74,924 respectively for an average of about $57,500.6 As noted above,

we agree with the trial court’s finding as to defendant’s current full-time earning potential. As a

result, the record evidence indicates that plaintiff’s yearly net income is nearly seven times that

of defendant’s present net income and just over four times that of her potential full-time net

income.

FACTORS THE COURT SHOULD USE

Lastly, although the trial court properly declined to accept some of the amounts in

defendant’s proffered budget, it erred in dismissing some categories completely rather than

limiting the amounts. The purpose of spousal support is to make certain that the parties live as

close to their previous standard of living as possible without impoverishing either party. Magee

v Magee, 218 Mich App 158, 162; 553 NW2d 363 (1996).

COURT NEEDS A COMPLETE PICTURE

The factors that the trial court is to consider are designed to provide a complete picture of each parties assets, income, expenses, and earning ability, as well as a sense of the parties prior standard of living.

Here, where the trial court had no information on plaintiff’s monthly expenses, it failed to consider any of defendant’s living expenses, it failed to consider that plaintiff received the income-producing assets, and it

improperly considered plaintiff’s loan to pay the property settlement, we do not believe the trial

court rendered a fair and equitable decision. Gates, 256 Mich App at 436.

Under these circumstances, we conclude that it was error for the trial court not to order a

greater amount of support and for a longer period. This was a 35-year marriage. Defendant is 54

years old and is without higher education, with her only real work experience being unskilled

office work and keeping simple ledgers for a small family business. We find no basis in the

record for the court’s conclusion that a three-year period is sufficient for plaintiff to “learn new

skills and/or secure better employment.”7 Given that each party received substantial assets and

---

FOOTNOTE5 This relatively low year reflected a $33,377 improvement to the outbuilding on the couple’s

property, which was to be used as an office for the building.

FOOTNOTE6 This, of course, assumes that defendant does not obtain future income as a result of these

capital expenditures and treats them as total losses.

FOOTNOTE7 The court found that defendant had previously worked full-time for Independence Village at the same job she is presently performing on a part-time basis for $10 per hour, that she had

performed some manual labor in the family landscaping business, that she had done

housecleaning for others at some point, and that she ran the office and kept the books for the

couple’s landscaping business. The court noted that plaintiff has “some limited computer skills.”

Defendant testified that when her children were young she volunteered at the schools and had a

paid position at the school for about a year. After that, she occasionally cleaned homes, briefly

provided daycare services to one little boy, worked for an agency that provided some

homemaker services through a local agency and worked for Independence Village. Defendant

described her bookkeeping duties for the landscaping business as “entering checks into a book.”

Plaintiff presented testimony from a CPA who did his taxes and who he had hired to do the

landscaping company books after he and his wife separated. She testified that the bookkeeping

duties at the company involved “paying . . . bills and doing . . . payroll” and that she had not

examined defendant’s work because defendant used a “manual system” and started fresh each

year. Plaintiff testified that defendant would organize the expenses in a ledger but that he would

calculate the figures and determine the amount of receipts, expenses and income. More

generally, he stated that in regards to bookkeeping, “I would do some of it, and Christine, I

would say, though, she had a lot to do with it.” We do not believe that any of this evidence

provides a basis to conclude that, after three years, a 55-year-old woman will have obtained

higher paying employment than she is now capable of obtaining.

---

that plaintiff received the income-earning assets (the business), as well as having a far greater

earning potential over defendant, defendant should not be expected to consume her capital to

support herself. See Hanaway, 208 Mich at 295-296.

We remand for a determination of an increased amount and duration of spousal support.

We do not retain jurisdiction.

/s/ Douglas B. Shapiro

/s/ Pat M. Donofrio

-1Foot note 1 Under the terms of the agreement, plaintiff was to receive the following: a 2002 Jeep (value

unspecified); the marital home (valued at $219,500); Patrick’s business, Country Garden &

Landscape (valued at $51,000); plaintiff’s IRA (valued at $30,000); plaintiff’s life insurance with

Genworth Annuity and Farm Bureau; plaintiff’s CD (valued at roughly $11,000); and plaintiff’s

cash accounts (valued at roughly $12,000). Defendant was to receive the following: a 2003

Pontiac (value unspecified); defendant’s 401(k) (valued at $18,000); defendant’s IRA (valued at

$5,600); defendant’s life insurance with Farm Bureau; defendant’s CD (valued at roughly

$11,000); defendant’s cash accounts (valued at roughly $51,000); and a cash payment from

plaintiff for $119,000 to equalize the property settlement.

-

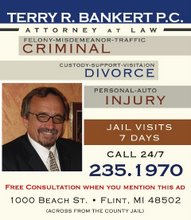

Posted here by

Flint Divorce Lawyer

Terry Bankert

http://attorneybankert.com/

Friday, July 02, 2010

Subscribe to:

Comments (Atom)