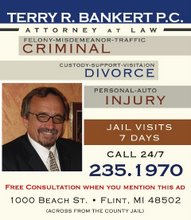

FYI-Flint Divorce Bankruptcy Attorney Terry R. Bankert 235-1970, www.attorneybankert.com asks DID YOU KNOW?.From Creative Tax and Financial Tips for the Low Asset/Underwater Case By Mary V. Ade, Stout Risius Ross, Southfieldningham JD CPA PC Troy

Accessing Funds in IRAs

The penalty exemption afforded to qualified plans does not apply to IRAs. However, do not overlook the possibility of tapping into IRAs.

- Exceptions to 10% Penalty RuleGenerally, if you are under age 59 1/2, you must pay a 10% additional tax on the distribution of any assets (money or other property) from your traditional IRA. Distributions before you are age 59 1/2 are called early distributions. The 10% additional tax applies to the part of the distribution that you have to include in gross income. It is in addition to any regular income tax on that amount.The following exceptions to the age 59 1/2 rule may be particularly relevant in a divorce context. Even if you receive a distribution before you are age 59 1/2, you may not have to pay the 10% additional tax if you are in one of the following situations.

- You are receiving distributions in the form of an annuity.

- The distributions are not more than your qualified higher education expenses.

- Your unreimbursed medical expenses are more than 7.5% of your AGI.

- The distributions are not more than the cost of your medical insurance.