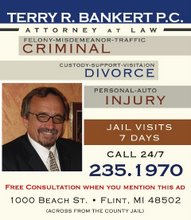

By Terry Bankert http://attorneybankert.com/ Divorce, Custody, Child Support, Alimony. Flint Michigan Lawyer.

Most property that is acquired during marriage is considered marital or community property.

For example, wages earned by the husband and wife during marriage generally are considered marital property. If one or both spouses buy a house or establish a business during the marriage, that usually will be marital property, particularly if the house or business is purchased with the husband's and wife's earnings.

Separate property is property that each spouse owned before the marriage. Separate property also includes inheritances and gifts (except perhaps gifts between spouses) acquired during marriage. During and after the marriage, each spouse may keep control of his or her separate property. Each spouse may buy, sell, and borrow money on his or her separate property. Income earned from separate property, such as interest, dividends, or rent generally are classified separate property. However, in some states that recognize community property, these profits may become marital property.

Separate property can become marital property if it is mixed with marital property. If, for example, a wife owned an apartment building before the marriage and she deposited rent checks into a joint checking account, the rent money probably would become marital property, although the building is likely to remain the wife's separate property as long as she kept it in her name. If the wife changed the title on the building from her name alone to the names of both herself and her husband, that probably would convert the building into marital property. In addition, if one spouse put a great deal of work into the other spouse's separate property, that could convert the separate property into marital property, or it could give the spouse who contributed the work a right to some form of payback.

A husband and wife may own property together during the marriage. This occurs automatically in community property states. Ten states: Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin, as well as Puerto Rico, use the community property system. These jurisdictions hold that each spouse shares equally the income earned and property acquired during a marriage. This is true even if one spouse supplied all the income. In the other states, spouses generally share property under one of the following three forms of co-ownership

Joint tenancy. A form of ownership that exists when two or more people own property that includes a right of survivorship. Each person has the right to possess the property. If one partner dies, the survivor becomes the sole owner. Any two people--not just spouses--may own property as joint tenants. A creditor may claim the debtor's interest in joint tenancy property.

Tenancy by the entirety. Allowed only in some states, tenancy by the entirety is a type of co-ownership of property by a husband and wife. Like joint tenancy, it includes a right of survivorship. But a creditor of one spouse may not attach (seize) the property. Each party usually must consent to the sale of the property. Divorce may result in a division of the property.

Tenancy in common. This form of co-ownership gives each person control over his or her share of the property, and the shares need not be equal. The law does not limit tenancy in common to spouses. A tenancy in common has no right of survivorship; when one spouse dies, his or her share passes to the heirs, either by will or state laws.

Q : May one spouse make a tax-free gift to the other spouse?

A : A person may give his or her spouse any amount of money without paying federal gift taxes if the spouse is a U.S. resident. However, it must be an outright gift or set up as a proper trust.

Most, but not all, state laws have done away with taxes on gifts between spouses. But the same is not true with respect to gifts to other family members. Gifts to children or other relatives may be taxable if they exceed a certain amount per year.

Q : Is a wife or husband liable for the other's business debts?

A : Usually, no--unless the husband or wife had co-signed on the debt or they reside in a community property state. It is common, however, for institutions that lend money to small businesses to want personal guarantees of payment from the owner of the business, and not just from the business itself. In the event the debt is not paid, lenders would like as many pockets to reach into as a possible. If the owner of the business owns a home, the lender may want to use the home as collateral for the business loan. That means that the spouse of the business owner may be asked to sign a paper allowing use of the home as collateral. Thus, the home could be lost if the business cannot pay off its debts. As long as a spouse does not co-sign for the business debts, the spouse normally will not be liable for business debts incurred by his or her mate. An exception may exist in community property states.

Q : May a couple file jointly for bankruptcy?

A : Yes. Bankruptcy provides relief for people who have more debts than they can pay.

Q : Must a working spouse provide a pension for a dependent spouse?

A : The law does not specifically require this, but most pension plans provide for it. Also, depending upon the type of pension plan, a dependent spouse is given certain rights under federal law regarding the working spouse's pension benefits.

Q : Do a spouse's credit rights depend on marital status or the other spouse's financial status?

A : The law forbids denying credit on the basis of marital status.

Q : Do the tax laws penalize married couples?

A : That depends on the tax bracket of each person. If one has a high taxable income and the other a relatively low taxable income, they will generally pay less income tax if they are married and filing a joint return than they would pay if single and filing as single persons. They also will pay less by filing a joint return than by filing separate returns (as married persons). For couples in which both wife and husband have a high income, the total tax will be higher for those who file jointly.

Years ago, there were stories about financially well-off married couples who would go to the Caribbean each December, obtain a divorce, file tax returns as single persons for that year to save money, and then remarry in the new year. Such a practice could be regarded as tax fraud. In any case, the savings are not as great as they were in years past.

Q : Is a husband or wife liable for the debts of the other without co-signing for the debt?

A : That again depends on the nature of the debt and where the couple lives. Some states have "family expense statutes" that make a husband or wife liable for expenses incurred for the benefit of the family, even if the other spouse did not sign for or approve of the expense in advance. Still other states impose this family expense obligation by common law without a statute. Thus, if the wife charged groceries at a local store or took the couple's child to a doctor for care, the husband could be liable because these are expenses for the benefit of the family. On the other hand, if the wife runs up bills for a personal holiday or the husband buys expensive coins for his coin collection, the other spouse normally would not be liable unless he or she co-signed for the debt. Again, in community property states, a husband or wife is generally obligated for the debts of the other.

Q : Is a husband or wife responsible for debts incurred by the other?

A : That depends on the nature of the debt as well as where the couple live. If both husband and wife have co-signed for the debt, both will be responsible for paying it. For instance, assume the husband and wife apply together for a charge card. If both sign the application form and promise to pay the charge bills, both will be responsible for paying off the balance to the credit card company or store, even if only one of them made the purchases and the other disapproved. Similarly, if a husband and wife co-sign on a mortgage for a home, both of them are potentially liable to the mortgage company, even if one of them no longer lives in the home. In community property states, a husband and wife may likewise be responsible for debts incurred by the other.

Q : Is one spouse responsible for debts the other spouse brought into the marriage?

A : Not in most states. In states that do not recognize community property, such debts belong to the spouse who incurred them. But in community property states, a spouse may, under special circumstances, become liable for the other spouse's premarital debts.

By:http://attorneybankert.com/

Wednesday, September 13, 2006

Subscribe to:

Post Comments (Atom)

1 comment:

Act Like A Lady Think Like A Man, is a must read e-book for both women and men. If you're trying to get over the hurt of a broken heart, trying to get out of a bad relationship or hoping not to get into one, this is the book for you. If you are lonely and haven't been able to find Mr. Right, wouldn't know him if you met him or if you've found him and are worried about keeping him, folks this is the book! If you are unhappy, suffer from low self esteem, are over weight and don't feel good about yourself or just feel like your life is going no where, this book can help put your life on the right track. It's a life changer for both single and married women. Do yourself a favor and preview the e-book at; actlikealadythinklikeaman.com

Post a Comment