Do you need help now?

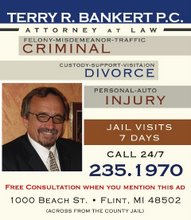

By Attorney Terry Ray Bankert 810 235-1970

http://attorneybankert.com/Divorce, Custody, Child Support, Alimony, Child Neglect, Flint Michigan USA Lawyer. http://terrybankert.blogspot.com/

Since the mid-1980s, not a year has gone by without federal and state politicians making proclamations about unpaid child support. Like the perennial "War on Crime," progress to improve child support collection is slow and new laws are not a full solution to the problem. What is needed is an aggressive use of current laws to protect children and relieve the hardship of a newly single parent with limited income. The Office of Friend of the Court is the parents advocate. There is no position , short of a judge, that can do more to protect children in a divorce. The importance of the next person selected to serve in this position cannot be overstated.

Did you know the Census Bureau reports that only about half of the parents entitled to receive child support receive the full amount that is due.

About one-quarter of parents to whom support is due receive partial payments, and the other one-quarter receive nothing at all. The Census Bureau estimates that each year, about $10 billion dollars in court-ordered child support is not paid.

In addition to that, there are several million mothers who have not obtained orders of child support for their children. A high proportion of those women had children out of wedlock.

For women who actually receive child support, the average amount owed is $3,767 per year, or about $314 per month. (These are 1995 figures--the last year in which a complete survey was done.)

Non-payment by fathers is not the only child support enforcement problem. Prosecutors who handle support collections estimate that between 2 and 5 percent of their cases involve mothers who did not pay their child support obligations. Mothers' payment rates are worse than fathers'. 57 percent of mothers pay all or a portion of their court-ordered child support payments; 70 percent of fathers pay all or a portion of their court-ordered child support payments.

Payment of child support correlates with visitation with time spent with the child. The Census Bureau reports that 74 percent of fathers with joint custody or visitation paid child support, whereas only 35 percent of fathers without joint custody or visitation paid support.

The cost of trying to collect unpaid child support is substantial. According to the U.S. Office of Child Support Enforcement, in Fiscal Year 1997, child support enforcement agencies spent $3.4 billion to collect about $13.3 billion in child support. In other words, each dollar of administrative costs generated about $3.91 of child support payments (although some portion of child support payments would have been made without involvement of an enforcement agency).

Child Support Enforcement

State and federal governments have a variety of techniques for enforcing payments of child support. The most common is a wage deduction order, by which an employer sends a portion of the obligor-parent's wages to a state agency that then sends the money to the parent who has custody of the child.

Enforcing Court Orders for Support and Parenting Time

When a parent does not meet the child support obligation, the friend of the court office works to enforce the support order. Federal and state laws provide a variety of enforcement measures to encourage or force compliance with the support order. Parents who are in arrears on child support may be subject to the use of one or more of the following enforcement tools available to the enforcing agency:

Contempt of court (Show Cause) hearing

If support is not paid on time, the friend of the court or a party may begin a contempt action (known as a "show cause" hearing) by filing papers requiring the payer to appear in court.

If the court finds the payer in contempt, the court may require a payment toward child support or commit the person to jail. If it appears to the court that the payer may be confined to jail, the court is required to appoint an attorney for payers who cannot afford private counsel.

If a payer does not appear for a "show cause" hearing, the judge may issue a bench warrant for the payer arrest, so that he or she may be brought before the court. Once a bench warrant is issued, the duty to arrest usually lies with local law enforcement agencies. A bench warrant issued for failure to appear for a contempt of court hearing is only valid within the State of Michigan.

Consumer (Credit Bureau) reporting

The friend of the court must report to a consumer reporting agency (credit bureau) the arrearage amount for each payer with two or more months of support arrearage. Lenders will often obtain a credit report from a consumer reporting agency when deciding whether to extend credit. If the credit report shows a history of untimely support payments or a large arrearage, the report may result in a denial of a loan or other credit.

New Hire reporting

Employers must report basic information about all their newly hired employees to the Michigan New Hire Reporting Center. Each state child support computer system receives data provided through new hire reporting. The child support office staff use the information to locate noncustodial parents and to establish or modify child support orders.

Driver license suspension

Driver licenses may be suspended for noncustodial parents who:

Are at least three months behind in paying their child support obligations.

Are not in compliance with a payment plan.

Before a driver license is suspended, the noncustodial parent is notified in writing. The parent can avoid a license suspension by showing that there is a mistake regarding the amount of the arrearage or by entering into an agreement accepted by the court for the payment of the arrearage.

Occupational license suspension

Noncustodial parents who are working in occupations that require a license from state, county, or municipal boards or agencies (e.g., electrician, real estate, barber, plumber) may have their licenses suspended if they:

Are at least three months behind in paying their child support obligations.

Are not in compliance with a payment plan.

Noncustodial parents receive notice of a pending suspension and can request a hearing before the license is suspended.

Recreational license suspension

Passport denial

Passport applications may be denied when noncustodial parents:

Are at least $5,000 past due in their child support obligations.

Are not in compliance with a payment plan.

The U.S. State Department reviews passport applications to see if past due child support is owed.

Tax refund intercept

The child support office can collect past due child support from a parent state income tax refund. It can also intercept federal income tax refunds and rebates.

To obtain assistance with enforcing a child support order, contact your local friend of the court.

Other income

If a noncustodial parent owes past due child support, the child support office may take periodic or lump sum payments the noncustodial parent receives from state or local agencies, including:

Unemployment insurance

Workers compensation

Lottery winnings

Liens

A lien is a claim against real or personal property. Once a person holding the property is informed of the lien, that person must not allow the property to be sold or transferred until the lien is released.

Property (including assets held in financial institutions) can be seized and the proceeds used to satisfy child support arrearages if the payer is over one year behind in child support arrearages.

If you have questions regarding the enforcement of a court order for custody, parenting time, or support.

Beginning in 1994, all new child support orders were required to provide for an automatic deduction from the obligor's wages. The wage deduction takes effect immediately unless the parties have agreed otherwise or unless a court waives immediate deductions from wages.

Even with such a waiver or agreement, the order must provide that a wage deduction will begin without returning to court if the person owing child support falls more than thirty days behind in payments. Wage withholding can be used to collect current support as well as past-due support.

Wage deduction orders are effective in collecting support if the parent is regularly employed and does not change jobs frequently.

If the parent loses a job, there is, of course no wage from which to make a deduction. If the parent changes jobs, the new employer must be served with a deduction notice before wages are withheld.

If a parent is self-employed, the parent is still obliged to send payments, but the person to whom support is due cannot look to an independent employer to make sure that payments are sent on time.

For parents who are behind in support payments, the state also can intercept federal and state tax refunds. This is a useful remedy if the obligor-parent has a sizeable refund due. If the obligor filed a joint income tax return with a new spouse, the new spouse can show the enforcement authorities the portion of the income tax refund that belongs to him or her so that the spouse's portion of the refund will not be intercepted. As a matter of pragmatics, the tax intercept usually is helpful for only one year. Once an obligor-parent has had a substantial tax refund seized, that parent often adjusts deductions of taxes from wages so that refunds in future years will be minimal.

In addition to seizing tax refunds, states also can place liens on property, such as real estate and automobiles to obtain past-due support.

Another penalty that states may impose on parents who have not paid support is a finding of contempt of court. A finding of contempt of court means that the person charged with contempt has willfully not done something that he or she has been ordered to do by the court--in this case, to pay child support.

A finding of contempt of court can result in a fine, a jail term, or both. If the parent cannot pay support for a good reason, such as loss of a job without fault of the parent, a court will not find the parent in contempt, but the obligation to pay support continues.

To enforce child support orders when the child lives in one state and the obligor lives in another state, the laws can be used to establish support orders and collect payments. The main law in this areas is the Uniform Interstate Family Support Act (UIFSA).

State's attorneys or district attorneys are available to help with collection of child support, though their efficiency varies from district to district. Some parents to whom support is due have complained of delays in handling of support claims. States attorneys provide their services at no costs to parents who are receiving public aid. For parents who do not receive public aid, the states attorney also can provide assistance, but a small charge (usually less than $25) may apply.

Private attorneys can help parents with collection of child support.

The attorney's normal rates will apply, although some attorneys may be willing the handle the case for a contingency fee , which means the lawyer will take a portion of whatever is collected, but the client will not have to pay the attorney if nothing is collected. The permissibility of contingency fees to collect past-due support varies from state to state. The amount of the contingency fee also varies, but a payment to the attorney of one-third of the amount collected is a common arrangement.

Attorney fees also can be assessed against the party who was supposed to pay support, but did not. In that case, the parent who was supposed to pay support will pay for the attorney of the other parent in addition to his or her own attorney fees.

Another way of collecting past-due child support is to use a collection agency. Some collection agencies will handle collection of child support just as they handle collection of business debts or credit card debts. Collection agencies usually charge a contingency fee. Collection agencies can be found through the Yellow Pages (particularly the "Business" volume of the Yellow Pages, if there is a separate volume for business-related services).

Although prosecutors involved in punishing parents who do not pay child support usually work for state or county governments, federal prosecutors can get involved too. In 1992, Congress passed the Child Support Recovery Act, which makes it a federal crime to willfully fail to pay child support to a child who resides in another state if the past-due amount has been unpaid for over one year or exceeds $5,000. Punishments under the federal law include up to six months imprisonment and a $5,000 fine for a first offense, and up to two years imprisonment and a $250,000 fine for a repeat offense.

Federal prosecutors are not the primary enforcers of past-due child support payments. Most U.S. Attorneys prefer to use their resources for larger scale criminal activity, although they will pursue some of the more egregious cases. For parents seeking government help in collecting child support, local prosecutors are likely to have more to offer than federal prosecutors, unless the amount of past-due support is very large and the obligor lives in a different state than the parent to whom support is due.

Most parents who owe support do not make a such career out of avoiding support obligations. Nonetheless enforcement of support can be difficult.

As noted earlier, one of the most commonly used tools for collecting support--automatic deduction for the obligor's wages works only if the parent to whom support is due or the government know where the obligor is working and the obligor's employer has been served with papers ordering the employer to deduct child support payments from wages.

Serving an employer with a deduction order is a simple process; it generally can be done by mail. But first, the government or parent to whom support is owed needs to know where the employer is.

Another technique to try to force payment of child support is to make the granting or renewal of certain types of licenses contingent on payment of support. If an obligor does not pay support, the obligor could lose his or her driver's license or professional license (such as a license to practice law or medicine or work as a barber, beautician, or plumber).

Maine was one of the first states to enact legislation to make licensing contingent upon payment of child support. Maine reported that as of early 1995, it collected approximately $25 million in past-due support as a result of the program. Maine found that the threat of license revocation often was enough to induce prompt payment. Of 21,000 persons who received warning letters from the state, well more than half of those persons made payments or entered into a written agreements to make payments. After the warning letters were sent out, only 400 parents received formal notice that their licenses would be revoked in twenty-one days and, of those, forty-one actually lost their licenses.

Proponents of making licensing contingent upon payment of child support like the comparative simplicity of the approach. Revocation (or threats of revocation) of licenses can be handled administratively. In some states, such as Maine, court hearings are not necessary as they are with some other remedies, such as actions for contempt of court.

Opponents of programs such as Maine's are concerned that an administrative system may not adequately take into account the hardship to an obligor who has lost a job or lost income and cannot afford to pay. If an obligor's professional license is revoked, the obligor's ability to pay may be harmed further.

The following is a checklist of techniques for collection of past-due child support:

Wage withholding orders--These are entered by a court and served on the employer of the parent who owes support. (The person who owes support is called the "obligor") The employer sends payments to the government, which then sends support payments to the parent to whom support is owed.

Tax refund intercepts--The government sends a notice to the Internal Revenue Service or the state department of revenue, directing that the obligor's tax refund be sent to the government for payment of support.

Liens on property--A lien can be placed on the real estate, automobile, or other property of the obligor. If support is not paid, the property can be confiscated and sold. Alternatively, the lien may stay on the property until it is sold by the obligor, at which point, the debt must be paid before the obligor receives any proceeds from the sale.

Contempt of court--The person to whom support is due or the government can ask a court to hold the obligor in contempt of court for willful failure to pay support. If found guilty of contempt of court, the obligor can be jailed, fined, or both.

Collection agencies--Some collection agencies are willing to help collect past-due support, just as they collect past-due commercial debts. Collection agencies usually charge a portion of the amount collected.

Revocation of licenses--States will revoke the driver's license or professional licenses of persons who have not paid child support.

Interstate collections--In addition to the remedies just listed, state and federal statutes are available to facilitate enforcement of support orders when the obligor and the person to whom support is due live in different states. State and federal prosecutors can help with interstate collections.

By Attorney Terry Ray Bankert 810 235-1970

http://attorneybankert.com/Divorce, Custody, Child Support, Alimony, Child Neglect, Flint Michigan USA Lawyer. http://terrybankert.blogspot.com/

09/14/2006

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment