Child support is any court-ordered payment of money for a child, including payment of the medical, dental, and other health care expenses; child care expenses; and educational expenses.

Fathers can be ordered to pay necessary expenses incurred by or for the mother in connection with her confinement or for her pregnancy is included as support.

For enforcement purposes, support also includes the surcharge added to past-due support payments in lieu of interest.

All child support calculations, including for interim orders and requests for modification, must begin with application of the Michigan Child Support Formula (MCSF).

The amount of child support recommended by the child support formula is presumed to be appropriate.

The formula is to be based on the needs of the child and the actual resources of each parent. Parents have a right to have their actual resources considered.

Numerous factors are considered, such as parental income, family size, child care, dependent health care coverage costs, and other criteria. The ages of the children are not factored in, although data shows that the costs of rearing a child increase with the age of the child. The formula is intended to apply in divorce cases, paternity cases, family support cases, and other cases involving the support of children. In addition, special provisions are made for low-income families, split custody, shared custody, and third-party custody situations.

Parental time offsets are built in to the support amounts and parenting time abatements have been eliminated.

An offset for parental time generally applies to every support determination, whether in an initial determination or subsequent modification and whether or not previously given.

There are many reason to not use the formula these are called Deviation Factors

Why? Strict application of the formula may produce an unjust or inappropriate result in a case

when any of the following situations occur:

(1) The child has special needs.

(2) The child has extraordinary educational expenses.

(3) A parent is a minor.

(4) The child’s residence income is below the threshold to qualify for public assistance,

and at least one parent has sufficient income to pay additional support that will

Child SUPPORT RAISE the child’s standard of living above the public assistance threshold.

(5) A parent has a reduction in the income available to support a child due to

extraordinary levels of jointly accumulated debt.

(6) The court awards property in lieu of support for the benefit of the child (§4.03).

(7) A parent is incarcerated with minimal or no income or assets.

(8) A parent has incurred, or is likely to incur, extraordinary medical expenses for

either that parent or a dependent.

(9) A parent earns an income of a magnitude not fully taken into consideration by the

formula.

(10) A parent receives bonus income in varying amounts or at irregular intervals.

(11) Someone other than the parent can supply reasonable and appropriate health care

coverage.

(12) A parent provides substantially all the support for a stepchild, and the stepchild’s

parents earn no income and are unable to earn income.

(13) A child earns an extraordinary income.

(14) The court orders a parent to pay taxes, mortgage installments, home insurance

premiums, telephone or utility bills, etc. before entry of a final judgment or order.

(15) A parent must pay significant amounts of restitution, fines, fees, or costs associated

with that parent’s conviction or incarceration for a crime other than those related to

failing to support children, or a crime against a child in the current case or that

child’s sibling, other parent, or custodian.

(16) A parent makes payments to a bankruptcy plan or has debt discharged, when either

significantly impacts the monies that parent has available to pay support.

(17) A parent provides a substantial amount of a child’s day-time care and directly

contributes toward a significantly greater share of the child’s costs than those

reflected by the overnights used to calculate the offset for parental time.

(18) Any other factor the court deems relevant to the best interests of a child

Every non custodial parent now has a right to have the number of over nights the children spend with them considered in calculating child support.

The rules of child support state at MCSG3.03(A) Presuming that as parents spend more time with their children they will directly contribute a greater share of the children’s expenses, a base support obligation needs to offset some of the costs and savings associated with time spent with each parent.

(1) Base support mainly considers the cost of supporting a child who lives in one

household. When a parent cares for a child overnight, that parent should cover

many of the child’s unduplicated costs, while the other parent will not have to

spend as much money for food, utility, and other costs for the child.

The rules also state it is important to know how many overnights the support order is based upon. MCSF 3.03(D)

If a substantial difference occurs in the number of overnights used to set the order and

those actually exercised (at least 21 overnights or that causes a change of circumstances

exceeding the modification threshold (§4.04)), either parent or a support recipient may

seek adjustment by filing a motion to modify the order.

The rules continue at 3.03(E). So the court can know if circumstances have changed at the time of a subsequent determination, every child support order must indicate whether it includes a parental time offset and the number of overnights used in its calculation.

Posted here

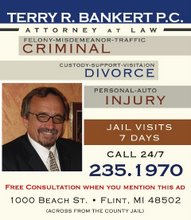

Terry Bankert

Sunday, November 23, 2008

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment