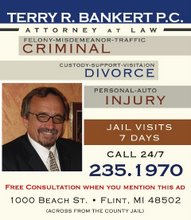

Recently a higher court reviewed the Oakland Circuit Divorce Court in its Family Division, LC No. 2007-741418-DM.The Divorcing husband said Oakland Divorce Court gave wife too much property. Flint Divorce attorney Terry Bankert presents this opinion. For questions or immediate help contact Divorce Lawyer Terry Bankert at 235-1970, area 810 Assets are always a question in divorce especially with older parties like Al Gore and Tipper Gore for instance.

AL,TIPPER GORE SPLIT PUTS FOCUS ON LATE-STAGE DIVORCES.[a]

Divorce attorneys and relationship counselors around the country say they've been seeing more "late-stage" divorces among Baby Boomers. And it's not because the kids have grown up and moved out.[a]

OLDER DIVORCING BOOMERS HAVE ASSETS TO DIVIDE

"It's the whole phenomenon of living longer, of having sex longer, of being healthier, oftentimes of being wealthier and feeling that they can easily pursue a no-fault divorce," says divorce lawyer John Mayoue of Atlanta. "I think we're seeing persons in long marriages questioning whether in fact there's a better life out there."[a]

The Gores knew as much. In their 2003 book, "Joined at the Heart," -- see how seriously they took this endeavor? They wrote a book about it! -- the Gores explored the way a prolonged life expectancy could affect American unions. "If couples are in unhappy marriages they are more likely to eventually divorce as they face so much of their lifetimes together after their child-rearing years are over," they wrote. [b]

AN OAKLAND COUNTY DIVORCE LOOKING AT SEVERAL ASSET ISSUES.

The higher court was the S T A T E O F M I C H I G A N C O U R T O F A P P E A L S. May 18, 2010 v No. 289740, , UNPUBLISHED

The Parties were BRIAN DAVID SKINNER, Defendant-Appellant. LAURA ANNE SKINNER, Plaintiff-Appellee

HUSBAND APPEALS THE JUDGEMENT OF DIVORCE

Defendant appeals as of right a judgment of divorce. THE MICHIGAN COURT OF APPEALS affirm, AGREE WITH THE OAKLAND DIVORCE COURT.

This court of appeals opinion was been altered by spacing and Cap headlines for lay clarity and SEO. Other citations will appear as [].

PRE MARITAL 401 K CONTRIBUTION AT ISSUE

Defendant first argues on appeal that the trial court erred in including the appreciation on

his premarital contribution to his 401(k) account in the marital estate.1

We THE MICHIGAN COURT OF APPEALS disagree.

WAS THERE CLEAR ERROR?

In a divorce action, this Court reviews the trial court’s factual findings, including whether

a particular asset constitutes marital or separate property, for clear error. Sparks v Sparks, 440

Mich 141, 151; 485 NW2d 893 (1992).

A FACTUAL FINDING REVIEW FIRST

A factual finding is clearly erroneous if the reviewing court is left with a definite and firm conviction that a mistake has been made upon reviewing the entire record. Draggoo v Draggoo, 223 Mich App 415, 429; 566 NW2d 642 (1997).

2ND WAS THE RULING FAIR BASED UPON THE FACTS

If the trial court’s factual findings are upheld, then this Court “must decide whether the dispositive ruling

was fair and equitable in light of those facts.” McNamara v Horner (After Remand), 255 Mich

App 667, 670; 662 NW2d 436 (2003).

WAS IT INEQUITABLE

“A dispositional ruling is discretionary and should be affirmed unless this Court is left with the firm conviction that the division was inequitable.” Id.

IS APPRECIATION PART OF THE MARITAL ESTATE?YES

A premarital asset’s appreciation is considered part of the marital estate “[w]hen one

[spouse] significantly assists in the acquisition or growth of [the other] spouse’s separate asset . .

. .” Reeves v Reeves, 226 Mich App 490, 495; 575 NW2d 1 (1997).

BUT THE APPRECIATION MUST BE ACTIVE

In contrast, a premarital asset’s appreciation should not be considered part of the marital estate if the appreciation is due to “wholly passive” appreciation.

See id. at 497.

WHAT IS PASSIVE APPRECIATION

A premarital asset increases in value by wholly passive appreciation when there is no addition of capital or active management during the marriage. See Dart v Dart, 460 Mich 573, 585 n 6; 597 NW2d 82 (1999).

HOW WERE THE INVESTMENTS MANAGED?

In Reeves, 226 Mich App at 495-498, this Court held that the marital estate included the

appreciation in value of the husband’s separate assets that he actively managed during the

marriage, but not the appreciation on his passive investments.

MOM TOOK CARE OF HOUSE DAD HAD TILE TO CARE FOR BUSINESS AND THE STOCKS WENT UP. MOM HAS AN INTEREST.

Similarly in Hanaway v. Hanaway, 208 Mich App 278, 293-294; 527 NW2d 792 (1995), this Court held that the marital estate included appreciation in stocks the defendant received from his family’s company because the plaintiff’s domestic efforts in managing the household and child raising allowed the

defendant to concentrate on building up the family company, which increased the stock value.

WHAT IF PRE MARITAL CONTRIBUTIONS WERE MADE.

In McNamara v Horner, 249 Mich App 177, 180-182; 642 NW2d 385 (2002), after

remand 255 Mich App 667 (2003), the parties had separate Michigan Credit Union retirement

funds and Mutual of America tax-deferred annuities (TDAs), which the trial court included in the

marital estate.2 The defendant appealed the trial court’s inclusion of the entire appreciation of

the parties’ retirement plans in the martial estate, arguing that because each party had made

premarital contributions to their own accounts, each party was entitled to have part of the

appreciation from the accounts excluded from the marital estate. Id. at 183-184.

This Court affirmed the trial court, holding that the appreciation in the value of the parties’ premarital

contributions was not because of a wholly passive investment. Id. at 184-185. After they

married, the parties contributed a percentage of their income to the retirement accounts and equal

amounts to the TDAs. Id. at 184. The parties’ premarital funds were thus commingled with

marital assets. Id. This Court found that the premarital assets in the retirement accounts and

TDAs did not increase in value because of wholly passive appreciation, but rather, because of the

additional contributions of martial assets as well as appreciation. Id. The Court held that the

parties’ commingling of premarital and marital assets made it impossible to accurately determine

the premarital appreciation of the assets, and thus, affirmed the trial court’s including the entire

appreciation amount in the retirement funds and TDAs as part of the marital estate. Id. at 184-

185.

Defendant argues that his case is distinguishable from McNamara, because he provided

the trial court with mathematically sound and uncontested formulas to determine the

appreciation on his $14,300 premarital contribution. However, because defendant’s premarital

contribution was commingled with approximately $150,000 in marital funds over the course of

some 23 years, any meaningful determination as to how much appreciation could be fairly

attributed to either the original balance or the contributions during the marriage is impossible,

defendant’s suggested interest calculations notwithstanding. Defendant further argues that the

increase in value of the 401(k) account was due to wholly passive appreciation because he was

only able to select mutual fund investments from a menu and was not active in the selection or

performance of the investments made by the mutual fund director. Although defendant did not

actively manage the investment decisions, the parties’ regular contributions of marital assets to

the 401(k) account throughout the marriage were a significant activity, and thus, the appreciation

in the 401(k) account was not wholly passive. See id. at 184-185. Consequently, it was not clear

error for the trial court to find that only defendant’s original balance was a separate asset.

The trial court’s dispositive ruling to deny defendant appreciation on premarital funds

was fair and equitable in light of the facts. Both parties contributed to the 401(k) account in that

plaintiff maintained the household and cared for the couple’s four children while defendant

generated the income needed to support the family. Marital assets funded the majority of the

401(k) account and the appreciation derived from the 401(k) account was to be for the mutual

benefit of both parties upon defendant’s retirement. The trial court gave defendant his premarital

principal contribution of $14,300 and ordered the remainder of the Fidelity fund to be equally

divided. Under these circumstances, the trial court did not err by concluding that it would not

benefit defendant with appreciation on the premarital portion of the 401(k) account.

Defendant next argues that the trial court’s valuation of the Fidelity IRA account (the

rollover of the 401(k) account) was clearly erroneous and that the trial court’s dispositional

ruling was inequitable. We disagree.

“For purposes of dividing property, marital assets are typically valued at the time of trial

or at the time judgment is entered.” Byington v Byington, 224 Mich App 103, 114 n 4; 568

NW2d 141 (1997). “[T]he court may, in its discretion, use a different date.” Id. We review the

trial court’s decision regarding the time of valuation for an abuse of discretion. Gates v Gates,

256 Mich App 420, 427; 664 NW2d 231 (2003).

At the September 2, 2008, trial in this case the parties stipulated that August 31, 2008

would be the valuation date for the various assets, including the Fidelity IRA account. On

August 31, 2008, the Fidelity IRA account was valued at $486,945.40. Due to deteriorating

economic conditions, by the time of the entry of judgment on December 10, 2008, the Fidelity

IRA account had diminished in value to $330,000, according to defendant. Citing language in

the trial court’s November 17, 2008, opinion and order, in which it held that “ . . . the parties will

divide the balance [of the Fidelity IRA account] equally,”3 defendant requested that the trial

court divide the remaining funds according to the account’s value as of the date of the final

order. Relying on the parties’ prior stipulation and noting that the delay between trial and entry

of a final judgment was not the fault of the court, the trial court denied defendant’s request. On

appeal, defendant claims that he did not stipulate to one-half of the August 31, 2008, valuation of

the Fidelity IRA account, but only that the parties would equally divide the assets after deducting

defendant’s premarital portion and any appreciation on the premarital portion as awarded by the

3 It should be noted that the November 17, 2008, opinion and order also references and attaches

what the trial court named “the August 31, 2008 Stipulation,” which was signed by the parties on

August 31, 2008, amended on the record on September 2, 2008, and which identifies the parties’

stipulations regarding premarital and marital assets and their values.

Defendant argues that the trial court’s reliance on the valuation of the assets as of August

31, 2008, was grossly unfair and has resulted in an obviously inequitable result.

During the September 2, 2008, trial, the court sought the parties’ agreement as to a

valuation date for asset distribution purposes. Pertinent portions of the trial transcript provide as

follows:

The Court. All right. When are you going to sit down and stipulate to the

values that you can stipulate to?

Defense Counsel. Well, I suggested that during our discussions today that we

take the stipulated facts, just the last two pages, which were the assets and

give the Court those which would have those stipulations and [plaintiff’s

counsel] refused.

The Court. Why is that—

Plaintiff’s Counsel. I agreed, not at all—

The Court. You did agree? Well, okay, then give it to me.

Plaintiff’s Counsel. Of course.

* * *

The Court. Okay. But see, for my purposes I have to know what date I’m

going to value these things because otherwise I’ll enter—I’ll do an opinion

and you’ll tell me, well wait a minute, those accounts have changed. Or

maybe you’re going to say to me I wanted to use the date as of the complaint

of divorce. I want to know if you’ve agreed on a date?

Defense Counsel. These are all—

Plaintiff’s Counsel. We agree on the last of August, which would be—

The Court. The accounts as of 8/31/08?

Plaintiff’s Counsel. Yes.

The Court. Okay.

Plaintiff’s Counsel. I’ll put that on here [“the August 31, 2008 Stipulation”].

Defense Counsel. Again, that’s the stipulation she was—we sent them back

over to her last week with those numbers and they’re marginally, they’re—

they’re—a lot of them are mutual funds and that account is a moving target.

The Court. That’s right, so that’s why I need a date. And I—you have just

told me that you’re going to agree to a valuation date of 8/31/08.

-5-

Defense Counsel. That’s fine.

“A party cannot stipulate a matter and then argue on appeal that the resultant action was

error.” Chapdelaine v Sochocki, 247 Mich App 167, 177; 635 NW2d 339 (2001). See also

Bonkowski v Allstate Ins Co, 281 Mich App 154, 168; 761 NW2d 784 (2008) (“A party may not

waive objection to an issue and then argue on appeal that the resultant action was error.”). As set

forth above, before agreeing to the stipulation, defense counsel noted that some of the assets

were mutual funds that fluctuated in value.

The trial court stated that was why a stipulation date regarding the value of the assets was needed.

The parties then stipulated to a valuation date of August 31, 2008

Therefore, this issue is waived. Even if defendant had not waived this issue,

the trial court acted equitably in seeking the parties’ stipulation regarding, and holding to, a fixed

date for valuation of the assets so that there would be no confusion or additional posturing with

respect to any upward or downward swings in the marketplace.4 Had the stock market risen after

August 31, 2008, plaintiff would not have been entitled to seek a different valuation date;

likewise, in the event of an economic decline, defendant was prevented from seeking a different

valuation date. Given the volatility of the market at that time and yet today, selecting exactly

what date would be proper under either circumstance would be difficult. While it is extremely

unfortunate that the market deteriorated as quickly and as unforeseeably as it did, we do not find

that the trial court abused its discretion in sticking to the parties’ agreed upon valuation date.

Affirmed. By judges , Patrick M. Meter, Christopher M. Murray, Jane M. Beckering

Posted here by

Flint Divorce Attorney Terry Bankert.

http://attorneybankert.com/

Or

http://dumpmyspouse.com/

FOOTNOTE

1 The 401(k) account has since been rolled over into a Fidelity IRA account because defendant

retired from Ford Motor Company.

2 The Court noted that the trial court properly removed from the marital estate each party’s

premarital contributions to their respective retirement and TDA accounts as part of the stipulated

premarital assets. Id. at 185 n 5.

4 The parties could have agreed that the asset valuation date would be the date judgment was

entered, but they chose August 31, 2008, which was essentially the time of trial

[a]

http://www.usatoday.com/news/health/2010-06-03-gore03_ST_N.htm

[b]

http://www.washingtonpost.com/wp-dyn/content/article/2010/06/02/AR2010060202373.html

Wednesday, June 02, 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment