Judgement language, St.Clair County Divorce, Flint lawyer, Step Mom and insurance proceeds, who get what?

WHY DID A ST.CLAIR COUNTY DIVORCE DECISION GOE TO SUPREME COURT, These Issues presented by Flint Divorce ATTORNEY Terry Bankert 235-1979:

1.INSURANCE COMPANY DISTRIBUTIONClaims related to the erroneous payment of insurance proceeds to defendant-Cindy Genaw;

2,AMBIGUITY Interpretation of MCL 552.101(2); Houdek v. Centerville Twp.; Metropolitan Life Ins. Co. v. Church; Notice; Schepke v. Department of Natural Res.; Thom v. Washington Nat'l Ins. Co.; ERISA; Sweebe v. Sweebe; Moore v. Moore

MICHGIAN St. Clair Divorce insurance issue to be reviewed by the Michigan Supreme Court Order in its order of ,June 4, 2010. For reference Supreme Court #SC: 140017, Michigan Court of Appeals #COA: 284214

The case is based on a MICHIGAN St, Clair Divorce decision litigated in St Clair Probate Court : 07-000069-CZ

Case Name: Genaw v. Genaw ,GAYLORD GENAW, JR., Personal Representative of the Estate of Gaylord Genaw, Sr., Plaintiff-Appellee, v CINDY GENAW, Defendant,and

UNUM LIFE INSURANCE COMPANY, Defendant-Appellant. e-Journal Number: 46010

Judge(s): Cavanagh, Weaver, Corrigan, Young, Jr., and Markman; Dissent - Kelly; Voting to deny leave to appeal - Hathaway. Additions for lay understanding and SEO noted as CAP headlines or [trb]

THE MICHIGAN SUPREME COURT SAYS THE MICHIGAN COURT OF APPEALS MAY HAVE GOT IT WRONG

In an order in lieu of granting leave to appeal, the court reversed the judgment of the Court of Appeals in a published opinion for the reasons stated in the Court of Appeals dissenting opinion, and remanded to the probate court for entry of an order granting defendant-Unum's motion for summary disposition.

AGAIN INSURANCE COMPANY OFF THE HOOK!

The defendant-insurer was discharged from all liability under MCL 552.101(2) when it paid the policy benefits to the named beneficiary prior to receiving any notice of a competing or adverse claim to those benefits.

RIGHTFULLY JUSTICE KELLY DOES NOT AGREE

In her dissent, Justice Kelly would grant leave to appeal to resolve the differing interpretations of MCL 552.101(2), which addresses entitlement to life insurance proceeds after a divorce.

BEWARE UNLESS YOUR DIVORCE JUDGEMENT SAYS OTHERWISE INSURANCE PROCEEDS WILL GO TO INSURED.

The statute declares, "absent an express designation to the contrary, once a divorce is final all policy benefits are payable to the insured."

WHAT HAPPENS WHEN EX SPOUSE LEFT OFF AFTER DIVORCE

This addresses the problems posed when an ex-spouse is inadvertently left as the named beneficiary after a divorce. Another clause protects insurance carriers. It provides a carrier is discharged from liability for distribution of the insurance proceeds if it pays them to the named beneficiary, absent notice of a competing claim.

THE HIGHER COURT’S JOB IS TO CLARIFY THE LAW

The Supreme Court should resolve the correct interpretation of MCL 552.101(2). The majority "hastily accepted the dissenting opinion as correct" without full briefing or oral argument.

THE EX WIFE IS A PERSON OF INTEREST

Under the language of the statute, petitioner's ex-wife, a named beneficiary of the policy, appeared to be a "person having interest in the policy." The statute does not contain a requirement the notice be given by someone other than the named beneficiary or the insurer be advised of a competing claim to the insurance benefits.

SUPREME COURT REVERSES THE COURT OF APPEALS

On order of the Court, the application for leave to appeal the October 6, 2009

judgment of the Court of Appeals is considered and, pursuant to MCR 7.302(H)(1), in

lieu of granting leave to appeal, we REVERSE the judgment of the Court of Appeals

THE SUPREME COURT AGREES WITH THE COURT OF APPEALS DISSENTBY C.J.KELLY

for the reasons stated in the Court of Appeals dissenting opinion, and REMAND this case to

the St. Clair Probate Court for entry of an order granting defendant Unum Life Insurance

Company’s motion for summary disposition.

INSURANCE COMPANY OFF THE HOOK

The defendant insurer was discharged from all liability under MCL 552.101(2) when it paid the policy benefits to the named beneficiary prior to receiving any notice of a competing or adverse claim to those

benefits.

KELLY, C.J. (dissenting).

I would grant leave to appeal.

WHAT HAPPENS TO INSURANCE IN A MICHIGAN DIVORCE

At issue in this case is the interpretation of MCL 552.101(2), a statute that addresses entitlement to life insurance proceeds after a divorce.

THE LAW IS CLEAR SO WHAT IS THE PROBLEM

The statute declares that, absent an express designation to the contrary, once a divorce is

final all policy benefits are payable to the insured.

WHAT IF THE DIVORCE COURT ORDER WAS FOR THE SURVIVING SPOUSE NOT TO GET BENEFITS? BUT A MICHGIAN DIVORCE ATTORNEY MAKES A MISTAKE AND THE INSURANCE BENIFICIARY WAS NOT CHANGED? WAS IT THE MICHIGAN DIVORCE LAWYERS FAULT?

This addresses the problems posed when an ex-spouse is inadvertently left as the named beneficiary after a divorce.

MISTAKE OR NO MISTAKE BIG BUSINESS IS OFF THE HOOK

An additional clause protects insurance carriers. It provides that a carrier is discharged from

liability for distribution of the insurance proceeds if it pays them to the named

beneficiary, absent notice of a competing claim.1

GETTING TO THE POINT

The issue in this case is whether notice was provided to the insurance company.

Gaylord Genaw, Sr. was killed in a traffic accident just three days after he was divorced

from his wife.

THE ST.CLAIR COUNTY DIVORCE JUDGEMENT SAID WIFE NOT ENTITLED

The judgment expressly indicated that his ex-wife was not entitled to the

proceeds of his life insurance policy.

IT APPEARS THE ST. CLAIR COUNTY DIVORCE LAWYER DID NOT NOTIFY THE INSURANCE COMPANY OF WIFE’S DISENTITLEMENT!

However, his ex-wife’s designation as beneficiary on the policy was never changed. She took advantage of this after the accident and made a claim for the proceeds.

AT HUSBANDS DEATH WIFE TOLD THEM ABOUT THE DIVORCE, THEY NEVER READ IT AND PAID HER ANYWAY. WHY IS BIG ISURANCE LET OFF THE HOOK AGAIN?

Defendant paid them to her, even though she disclosed the divorce on the claim form and the death certificate she submitted to defendant also indicated that Gaylord was divorced.

STEP SON IN A LOVING THOUGHTFUL MANNER SUES HIS EX STEP MOTHER

When Gaylord’s son discovered that she had improperly collected the policy proceeds, he brought this action against her and against the insurance company.

ST.CLAIR COUNTY PROBATE COURT SAYS STEP MOM GIVE IT UP!

The trial court ordered the ex-wife to turn over to plaintiff what remained of the

proceeds. The court then held defendant liable for the remainder.

THE MICHGIAN COURT OF APPEALS ALSO SAID STEP MOM KEEP THE MONEY!

The Court of Appeals affirmed this action in a published split opinion.2 It found that the ex-wife qualified

As “any other person having interest in the policy” under MCL 552.101(2).

SHE TOLD THE INSURANCE COMPANY THERE WAS A DIVORCE, WHY NOT KEEP THE MONEY?

Because she Had given defendant written notice of the divorce, the court found that defendant had received

notice according to the statute and was therefore responsible for wrongfully disbursing

1

ST.CLAIR COUNTY, MICHIGAN, DIVORCE AND INSURANCE

MCL 552.101(2) states, in its entirety:

Each judgment of divorce or judgment of separate maintenance shall

determine all rights of the wife in and to the proceeds of any policy or

contract of life insurance, endowment, or annuity upon the life of the

husband in which the wife was named or designated as beneficiary, or to

which the wife became entitled by assignment or change of beneficiary

during the marriage or in anticipation of marriage. If the judgment of

divorce or judgment of separate maintenance does not determine the rights

of the wife in and to a policy of life insurance, endowment, or annuity, the

policy shall be payable to the estate of the husband or to the named

beneficiary if the husband so designates. However, the company issuing

the policy shall be discharged of all liability on the policy by payment of its

proceeds in accordance with the terms of the policy unless before the

payment the company receives written notice, by or on behalf of the insured

or the estate of the insured, 1 of the heirs of the insured, or any other

person having an interest in the policy, of a claim under the policy and the

divorce. [Emphasis added.]

2 In re Genaw Estate, 285 Mich App 660 (2009).

3

the funds.3 The dissenting judge would have held that a named beneficiary cannot

qualify as an “other person having interest in the policy.”4

WHAT IS THE CORRECT INTERPRETATION? WHAT IT SAYS OR WHAT IT MEANS J

The Supreme Court should resolve the correct interpretation of MCL 552.101(2).

THE COURT OF APPEALS WAS IN A SLOPPY HURRY?

The majority has hastily accepted the dissenting opinion as correct without the benefit of

full briefing or oral argument.

ONE SUPREME COURT JUSTICE IS TROUBLED!

I find this troublesome because, under the language of the statute, petitioner’s ex-wife, a named beneficiary of the policy, appears to be a “person having interest in the policy.”

JUST WHAT KIND OF NOTICE IS ADEQUATE

Nowhere does the statute contain a requirement that notice be given by someone other than the named beneficiary or that the insurer be advised of a competing claim to the insurance benefits.

THEY NEED PERMISSION OF LEAVE TO APPEAL, IT WAS GIVEN.

Accordingly, I would grant leave to appeal to resolve the differing interpretations

of the statute.

3 Under the factual circumstances of this case, it is undisputed that Unum received a

claim from Genaw that specifically acknowledged both her status as the ex-wife of the

decedent and the existence of a divorce. Consequently, this information, submitted in

conjunction with her claim, was sufficient to meet the notice requirement imposed by the

existing statutory language, and the insurance company was not absolved of its liability

for payment of the proceeds to the designated beneficiary. [Id. at 669.]

PLAIN LANGUAGE

4 [T]he plain language of the statute absolves an insurer of liability for paying its

proceeds in accordance with the terms of the policy unless before the payment it receives

written notice of a claim and of the divorce from one of the persons identified in the

statute.

SPECIFIED PERSONS

These specified persons—(1) the insured or the estate of the insured, (2) the heirs

of the insured, or (3) any other person having an interest in the policy—are plainly ones

who could have an interest in the policy if the beneficiary designated in the policy no

longer had a right to the benefits of the policy.

CLAIM MAKING

A claim by such a person would clearly

give the insurer notice of the extinguishment of the former wife/beneficiary’s interest in

the policy and of the existence of a claim by one other than the beneficiary designated in

the policy. Thus, “other person” logically means a person other than the claimant

(beneficiary) already known to the insurer.

WRITTEN NOTICE NEEDED

Absent written notice of a claim under the

policy by one of the persons identified in the statute before making payment on its policy,

the insurer is discharged of all liability on the policy for payment of its proceeds in

accordance with the terms of the policy.

MOST IMPORTANT TO LET THE INSURANCE COMPANY OFF THE HOOK

This interpretation advances the clear purpose

of the statutory language at issue, which is to protect an insurer that pays its policy

proceeds in accordance with the terms of the policy absent the requisite notice of a claim

by someone other than the beneficiary designated in the policy. In my view, the plain

language of the statute mandates this conclusion. [Id. at 675-676; emphasis in original

(FITZGERALD, J., dissenting).]

HATHAWAY, J., would grant leave to appeal.

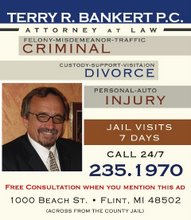

Posted 06/15/2010 here by

Terry R. Bankert

A Flint Michigan Divorce Lawyer

http://attorneybankert.com/

Or

http://dumpmyspouse.com/

Tuesday, June 15, 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment